Case studies are interesting to read. Imagine you were given an auditing case study on Lamborghini as the selected company, wouldn’t you do it as fast as they go? Of course, you would. But, in your case, fortune is a bit farfetched and you will have to survive on accounting case studies pertaining to companies like –

-

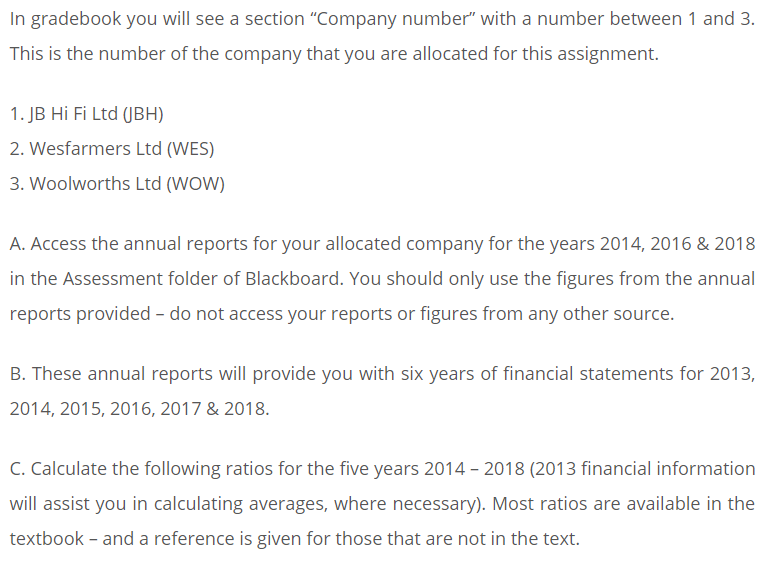

JB Hi Fi Ltd. (JBH)

-

Wesfarmers Ltd. (WES)

-

Woolworths Ltd. (WOW)

In Southern Cross University, the case study we are going to talk about has been found to be repeated every two or three years. You would definitely find it in your module at least once if you belong to that lucky, “fortunate” batch of accounting students.

Importance of Case Study in ACC00724 Accounting for Managers

Carrying 12 credit points, this PG course is going to help you develop your accounting skills. Your vantage point would undergo a change and you would begin to view things from a business manager’s perspective. You would view, interpret and analyse a number of management accounting reports which would inevitably fall your way when you pursue it as a career and lay your hands on prospect revolutionary business making or breaking decisions. So, you need not worry about yourself. You are in your own good hands!

Talking about the assignment, you are going to face a case study which is going to be company-centric and carry 20% of your annual assessment. Would you let that go and compromise with 20% of the grade in your assessment report?

JB JI FI Ltd. Accounting Case Study Assignment Help

ACC00724 accounting Case Study Assignment Example

ACC00724 accounting Case Study Assignment Answer

Flashback Time!

-

JB Hi Fi Ltd. (JBH)

-

Wesfarmers Ltd. (WES)

-

Woolworths Ltd. (WOW)

What are these? These are not just random companies but the ones you are going to centre your assignment on!

Moving on, the assignment asks you to calculate a number of ratios for which our advice is, you use only the annual report numbers given in the textbook.

The ratios you are going to answer are –

-

Return on total assets

-

Operating profit margins

-

Inventories turnover period

-

Current ratio

-

Debt to asset ratio

-

Asset turnover

-

Price-earnings ratio

-

Rate of return on normal equity

-

Gross profit margin

-

Settlement period for debtors

-

Quick ratio

-

Interest cover ratio

-

Earnings per share

Our Advice to Answer Case Study in ACC00724 Accounting for Managers

In order to calculate the above in a flawless manner, we recommend you to –

-

The first thing you must do is write the ratio formula.

-

Secondly, show the numbers and link it up with the formula.

-

Show the answer and make sure that you highlight it.

-

The answer shall be in a proper format; percentage, ratio, times, days and must extend up till two decimal places.

-

Once the answers are obtained and the ratios are up and ready for instant reference, you must then comment on the profitability, liquidity, efficiency, investment ratios and financial gearing of the companies (the most important in your ACC00724 Accounting for Managers Case Study).

For another quick tip read on.

Note: Do not forget or ignore the coverage that revolves around your company in the financial press as that would garnish your answers and make sure that you receive the highest grade possible for that particular section.

There are more section-by-section tips you must know to score your desired. Not all of them can possibly be listed down here. To know them, contact us via our email ID.

ACC00724 Accounting for Managers Case Study – The Mustn’t Forget

Your marking rubrics hints that whatever companies may come your way, the following points must be included as the VIPs of your Case Study Analysis in ACC00724. Our accounting case study analysis experts say that the marking rubric helps a lot when it comes to accurately and rightly answering the questions you are being assessed on. Here it goes –

-

-

The reporting of the financial position of the company.

-

Reporting of the cash flow of the company.

-

A detailed analysis of the financial statements of the company.

-

How do the companies manage to manage the working capital?

-

A prominent activity-based costing analysis of the company.

-

How is the organisation financed?

-

A report of the planning, budgeting and organisation of the process and the budget to plan all that when it comes to a particular company.

-

When you analyse the above ACC00724 case study or any given case study, the accounting parameters or aspects immediately above shall forever be tattooed on your body for future reference.

Yes, that is exactly how important they are to your case study analysis.

Our Accounting Case Study Help

You are just a few clicks away from reaching out to us. We might not share the same concealed creativity as Michael Scofield, but we are just as academically decent. We, at TutorVersal, have catalysed top-tier grades to a number of students who have approached us for our ACC00724 Case Study help at Southern Cross University. They have also repeatedly made use of our value-added services in order to gain an edge over the students who limit themselves with classroom teaching.

You need only let us know what case study you received for your assessment (inevitably) via a quick, 2-minute form and we would take care of even the customisations that you may enclose while you state what you require. If you have any other query related to accounting, you may wish to have a look at our accounting assignment help services as well.