For a student, it is not as relatable to possess a taxable income. We understand the struggles, you see? All you know about taxation law is via your curriculum.

Taxation law case study assignment help is often the search term you are bound to search for the technicalities of a taxation law assignment. You could be scrounging and scrounging for gold through different websites but still end up finding nothing valuable related to your subject!

The query that has come our way a million times is the case study assignment that you would find when you pursue law. The frequency of a case study being asked of you is 100% until and unless the universities decide to change their module and assessment tasks.

Brace yourselves for we are about to drop a bomb, right here! Do not run away for it will do the law students some good! We extend our online assignment help in Regional Aussie Bank Ltd Case study solution as well!

We have a few things lined up for you in this blog. We would do our best to keep the surprises yet to come to be of some value.

Among all the “LW3130 Revenue Law and Practises answers”, there is a reason why the Taxation Law Case Study answer is the most sought after.

LW3130 Case Study Analysis Example

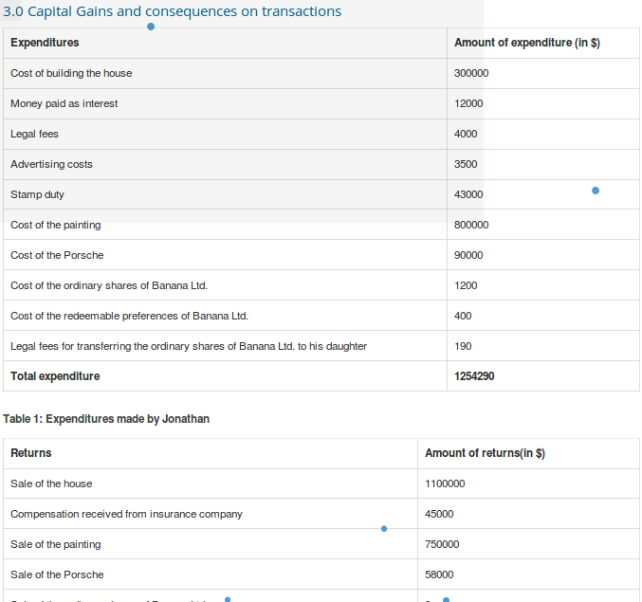

We are not going to attach the whole case study here. What we have done is tabulated the information that is necessary to analyse the case study in LW3130 Taxation Law Case Study Assignment.

Taxation Law Case Study Solution

From the above table, you can say that Jonathan has to do the following.

- From the above analysis, one can conclude that Jonathan is profiting from his transactions. Or, to make it even simpler, we can say that the total amount of money gained by Jonathan is 1100500. In the above-tabulated solution, you must notice that there is a legal claim of $400.

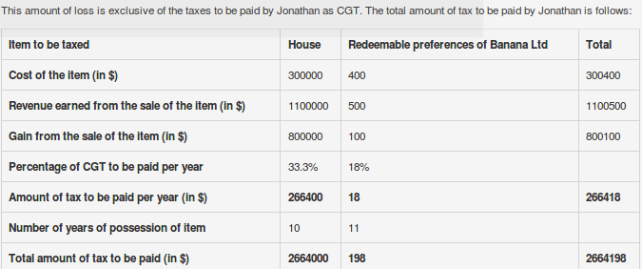

- We know you hate studying but you would need to dig a bit deeper in order to crack this assignment’s case study analysis. So, in regards to the Australian taxation system, the individuals that that are to pay the tax are also to pay the tax they are liable to pay as per their capital gains or individual loss of their companies.

- In the solution, you must include the fact that the 33.3% CGST of the discounted value, Jonathan made the buy of all the redeemable shares of Banana Ltd. The total amount that he paid was $400 in the year 2005.

- He sold the same shares at a profit and price of $5000 in February 2016. He added to his bag a profit of $100 per share.

The above parameters were precisely calculated analysed by our taxation law assignment help providers. They used their experience and expertise to get you the best version possible of their law assignment help services.

What you just read is only a synopsis of the episode that would help you answer the case study question. We do not want you to wait for the full solution like we are waiting for Game of Thrones’ next season even when the winter is here! Rather, we would like you to draw the sword out and penetrate through the Bolton Assignment cavalry and acquire the top tier grades!

But wait, who’s are going to be your Knights of the Wale?

Our Taxation Law Case Study Help

We, at TutorVersal, are! Our knights…error, experts are more than efficient and have almost a decade of experience of solving case studies, interpreting them, analysing them, and drawing deductions. With plagiarism free, and quality guaranteed case study analysis, where else would you go than our law case study assignment help providing experts?

Oh, we would love to hear from you. To tell you more, the process doesn’t even take much longer. You need only fill up a 2-minute form and you are free like a bird!