Disclaimer: The information in this blog is based on the experience possessed by the academic experts at TutorVersal during both their career as managers in MNCs and finance accounting assignment help providing. The “all-about” of a financial statement along with some tips on how to tackle a question file may be found below for reference purposes!

The word “DISCLAIMER” got you there, huh? Well, that’s okay. Proves you are only human. And humans work. If they work, they earn. They earn, they have to maintain records of what they earn and the expenditure. After a number of entries are there in the ledger, you get a final finance statement (yes, this is the one you are going to analyse).

What exactly is a financial statement?

Our finance assignment help experts have compiled an easily comprehendible definition. Analysis of the financial statement refers to an in-depth examination of the profitability, stability, viability of a business or a project. While pursuing finance as your major, you are going to be one such professional (if you do not switch your field).

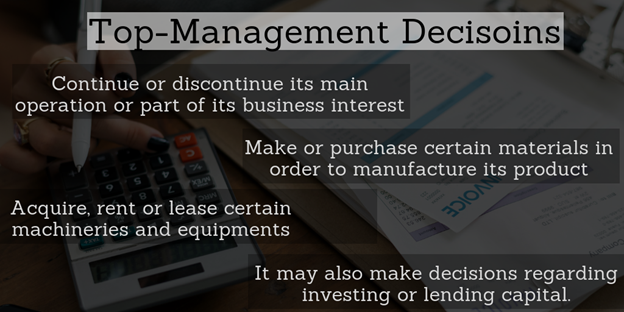

The report so obtained has to be presented to the top-level management. The report helps the management take monetary and budgetary decisions which are ideal for achieving the company’s vision, mission, objectives, etc.

Elements of a Financial Statement

Financial reports are nothing but a statement written or presented once in 3 months or a year. It comprises of at least a total of three accounting statements. Which are –

Statement of Income

It is shown by the formula

Net Profit = Revenue – Expenses

This is a formula you already know. An expert will add up all the figures (sales) to calculate the end gross profit of the firm he is doing it for. Adding up the expenses in a similar format will give him the end gross expenses (total expenses). According to the formula, when expenses are subtracted from the revenue, he would get how much profit the company has earned.

If he wishes to take it up a level (as per the demand of the firm), he may even subtract the taxes from the Revenue figure in order to know how much takeaways shall be there for the firm’s owner.

Statement of Cash Flow

There is no formula as such but a simple common sense in play here. It is the input cash (money) and output cash (money) that is denoted by the statement of cash flow.

Our finance accounting assignment help experts say that the cash flow is linked to everything and hence makes it an easy target for the formulation of finance accounting important assignment questions. You are in luck that our experts were born “ledger-handed”!

Balance Sheet

This is stage three. The “beat-the-dragon” stage! Oh boy, you would not believe how often you are going to trouble yourself with balance sheet assignment answers. They just do not match, eh? Do not worry, here’s a list of a basic “non-situational” balance sheet that you could treat as a basis for the balance sheets you attempt to match –

- The assets (amount of receivable), movable and immovable assets.

- Liabilities (the amount to be paid BY THE COMPANY) includes the taxes and expenses as well.

- Owner’s equity (refers to the owner’s monetary investment with which he/she began the quarter with).

The Formula

You could be wondering, why, in the first place, are you given a financial analysis assignment for which you had to google “financial analysis assignment help”? You would not be much surprised to know that gaining as much expertise you can when the above is concerned will make you able enough when you have to take decisions as per the company’s –

- Profitability

- Solvency

- Liquidity

- Stability

In order to analyse your firm on some basis, there are several methods that you can choose to do so.

Methods for Financial Analysis

The below are Profitability Ratio which is majorly used by professional economic analysts because they are the most suited and time-saving. For you, they could be a bit tricky.

The methods to get about a financial statement analysis are –

- Profit Margin

- Current Liquidity Ratio

- Debt Ratio

- Earnings Per Share

- Dividend Cover

There are more technical aspects that you would need to know in order to get yourself the grade you’ve always wanted in you semesterly assessment report. So, in order to save on time and effort, you may feel free to know more about the methods and learn how to do it or let us throttle the car forward by being in the driver’s seat! Let us know what you wish to do! If you wish to learn, our value-added services are present to support you or simply fill up the form and be done with all the assignment problems hurdling your way!